Feeling a lack of money from under the thick ceiling above your head that actuaries and other financial professionals and politicians and crooks have created, which work together to help keep you down financially? (And no, I’m not a conspiracy theorist! I’m just educated and experienced.) Well then, you might need to change your money paradigm. Paradigm shifts can help you progress or stifle in this world and specifically in the world of work and money.

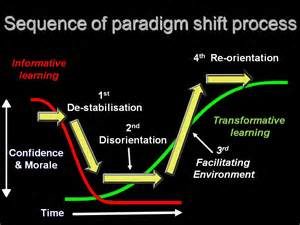

A paradigm is a framework or glasses, so to speak, through which a person sees or thinks about a certain topic–in this case, money and making money. Paradigms of thought naturally shift and change during personal growth. A lack of ability to handle a paradigm shift can get in your way, which actually means that you can get in your own way, when a potential paradigm shift becomes too confusing or scares you as it brings up the unknown and challenges thinking patterns you were taught growing up, perhaps some things that are even hidden deep in your mind.

A paradigm is a framework or glasses, so to speak, through which a person sees or thinks about a certain topic–in this case, money and making money. Paradigms of thought naturally shift and change during personal growth. A lack of ability to handle a paradigm shift can get in your way, which actually means that you can get in your own way, when a potential paradigm shift becomes too confusing or scares you as it brings up the unknown and challenges thinking patterns you were taught growing up, perhaps some things that are even hidden deep in your mind.

Freud saw three components to the structure of the non-physical mind: the id, ego, and super-ego as defined below:

Freud saw three components to the structure of the non-physical mind: the id, ego, and super-ego as defined below:

Id — In its simplest terms, the id is composed of our base instincts.

Super-ego — The super-ego works to moderate impulsiveness, encourages good morality, and generally plays the critical and moralizing role. The super-ego can stop a person from doing certain things that their id may want to do.

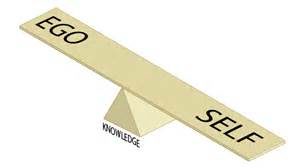

Ego — The ego is the organized and realistic part of the mind that I like to call the parent of the id and ego, which I see as two children with opposite drives in life.

I suggest that a money paradigm change begins with the ego

The ego, as I understand it, regulates everyday behavior and expectations, including the way one thinks about the relationships among money, action, and time. From my experience, the average person, assumes that there is a connection between money and time, the longer you work, the more money you will make. I note that there is truth to that assumption when one is paid a certain amount per hour. BUT, this puts a cap on earning potential based on the fact that there is a maximum of 24 hours in a day.

The ego, as I understand it, regulates everyday behavior and expectations, including the way one thinks about the relationships among money, action, and time. From my experience, the average person, assumes that there is a connection between money and time, the longer you work, the more money you will make. I note that there is truth to that assumption when one is paid a certain amount per hour. BUT, this puts a cap on earning potential based on the fact that there is a maximum of 24 hours in a day.

There is another group of people who don’t necessarily base money’s dependency on time. These individuals see money as a result of certain actions taken. Take the example of selling a car. If the price tag of that car is a non-negotiable price of $15,000, the seller will get 15,000 for selling the car whether the buyer takes 30 minutes or 3 hours to make the purchase. In this case, time is irrelevant and the action of buying the car determines the amount of money transacted based on the price of the car.

My recent experience in selling programs that make money, if anything, has shown me that people have a hard time switching from–thinking of money as tied to hours–to thinking of money as tied to action. I believe the strength of the ego is so formidable, that changing from the ingrained belief that “time = money” to a belief that “action = money” causes a cognitive dissonance so uncomfortable that the individual becomes anxious and often “gets in one’s on way.” The individual often cannot make the switch of one money paradigm (way of thinking about money) to the other money paradigm. That discomfort is so strong in some cases that clients make up excuses for not being able to continue a program that would literally make them very wealthy.

My recent experience in selling programs that make money, if anything, has shown me that people have a hard time switching from–thinking of money as tied to hours–to thinking of money as tied to action. I believe the strength of the ego is so formidable, that changing from the ingrained belief that “time = money” to a belief that “action = money” causes a cognitive dissonance so uncomfortable that the individual becomes anxious and often “gets in one’s on way.” The individual often cannot make the switch of one money paradigm (way of thinking about money) to the other money paradigm. That discomfort is so strong in some cases that clients make up excuses for not being able to continue a program that would literally make them very wealthy.

It is unfortunate that this helps propagate the dynamic of the rich getting richer and the poor getting poorer–especially with 1% of the population holding the world’s financial resources.

Could it be that the lack of money that the 99% find in their lives is at least somewhat self-imposed? I say, yes, absolutely. So, if you are lacking finances, ask yourself, do you need a paradigm change? Could you handle one? Or would you find yourself so uncomfortable with new ideas about money that you would make excuses for why it wouldn’t work–I don’t have time, I can’t do it, it’s a scam, it’s a pyramid, it’s not happening fast enough, it’s too hard, I can’t pay the money, and so on–just to avoid the discomfort of change? Well, perhaps the adage of nothing ventured, nothing gained is especially true in the world of money. I’m glad I’m a bit of a risk taker and can handle a good amount of cognitive dissonance.

Thanks, Rory Ricord, for communicating to me some of the money dynamics mentioned in this post. This would be a great research topic!

Visit my websites at: http://leslieoffers.com

http://leslieoffers.gamelootnetwork.com

Also: http://roryricord.com

Author Leslie Anderson Jones earned a double-major BS in Philosophy and Psychology and an MS in Technical Communication

Save